How to Track Business Expenses Easy Guide for 1099s & Small Businesses

Once you’ve tightened up your spending, you’re ready to explore financing options to further improve your cash flow. Switch to an accounting or small and mid-sized business (SMB) software solution for streamlining your cash flow. However, if you fail to manage cash flow, your business may encounter challenges that a profitable quarter cannot resolve. To be a small business entrepreneur means you have the drive, passion and a great idea to serve customers in new ways. However, it also means you need to stay organized and concentrate on the details of the business, including ways to manage cash flow.

- The calculation reflects the available cash that belongs to both equity and debt holders through a metric that helps evaluate operating effectiveness and money-generation capability.

- • Choose an account that fits your business’s cash flow needs and ensures you can access funds when necessary.

- Overstocking ties up cash in unsold goods, while understocking can lead to missed sales opportunities and dissatisfied customers.

- These accounts can offer an annual percentage yield (APY) of up to 5%, far outpacing the tiny 0.01% APY offered by traditional savings accounts.

- Small business finance is always tricky, especially during challenging times.

- No more waiting for physical checks to make their way through the postal system.

Join 41,000+ Fellow Sales Professionals

For instance, without the help of a cash flow statement, you could find yourself caught off guard by a seasonal dip in business. And if you happen to fall behind in payments because of it, you could cause damage not only to your reputation and relationships but also to your credit and financial standing. When you’re starting out, it’ll be tough to gauge how much you can realistically expect to make.

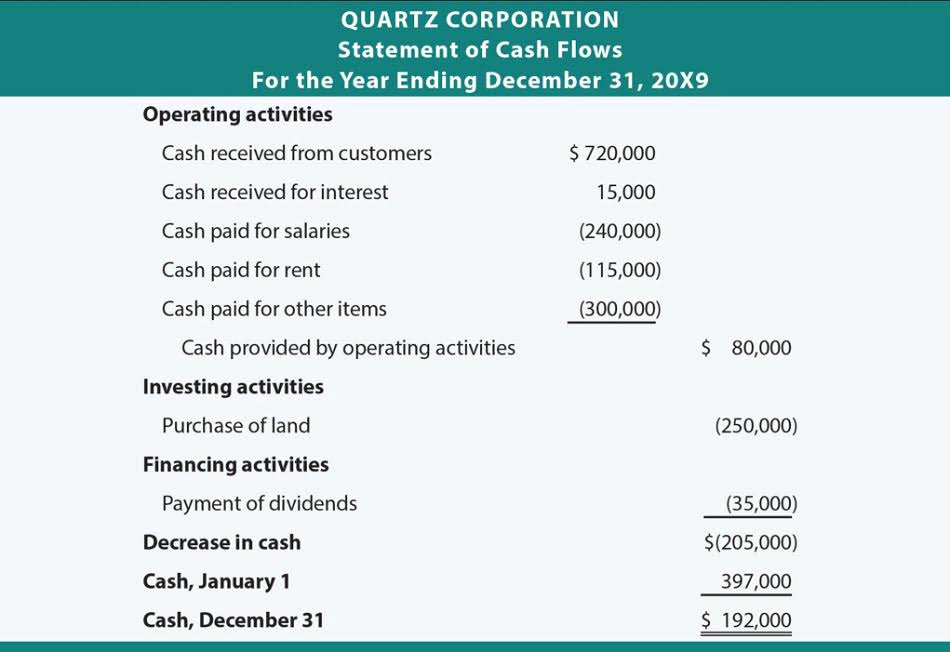

How Do You Analyze The Cash Flow Statement?

Start by tracking your cash flow from operating activities over time. Look at the core business if the line is erratic, with significant spikes and dips. Cash flow is the lifeblood of any small business, yet many owners struggle to manage it effectively, especially in Q1. This is often due to seasonal fluctuations, delayed payments from clients, or unexpected expenses. One of the biggest mistakes business owners make is not keeping proper records of their expenses.

- Regularly reviewing your expenses is akin to pruning a tree—it promotes growth and sustainability.

- So, now that you understand what cash flow is, let’s cover how to manage it.

- It’s a way to measure how long (in days, usually) each dollar put into the business is tied up in production and sales, before it is converted into cash.

- And since that’s true, you better believe that companies going through lean times often struggle with cash flow management.

- Cash flow is the lifeblood of any small business, yet many owners struggle to manage it effectively, especially in Q1.

- This plan will help you feel confident in your ability to meet all your financial goals and obligations.

Implement a Clear Payment Policy

Your day-to-day operations will function more smoothly, and you’ll be able to prepare and plan to navigate the future. You cash flow management strategies for small business can assess whether your business is ready to face a short-to-medium term financial setback or period of difficulty, and if not, what you can do to address it. Effective cash flow management empowers small businesses to take control of their payables and receivables and build a foundation for long-term financial stability and success. However, it’s a time and labor-intensive process, especially if your company relies on manual data entry and analytics to make sense of cash flow. Automating parts of your cash flow process can save your company time, free employees from repetitive, manual data entry, and improve the accuracy of your cash flow reporting.

Like What You’re Reading?

This approach benefits both your business and your customers by speeding up payments and providing them with savings. Once your payment process is running smoothly, you can look into other ways to manage big-ticket expenses, like equipment purchases, to keep your cash flow in check. Timing your payments smartly can take your retained earnings balance sheet cash flow management to the next level. When choosing a financing option, don’t just focus on interest rates. Look at the total cost, repayment terms, and how they align with your cash flow.

Improve inventory management

Finally, digital transformation in finance offers tools like forecasting and predictive analytics to project the long-term impact of adjustments. Poor cash flow management can lead to missed payroll, unpaid bills, and even bankruptcy. Efficient inventory management is especially critical for businesses that deal with physical products. Excessive inventory ties up capital and storage space, while insufficient inventory can result in missed sales opportunities. Employing inventory management software can revolutionise this aspect of cash flow management. Just remember to review and update your budget regularly to ensure that it is aligned with changes in the business’s operations, as well as seasonality and your sales cycle.

- Subtract the beginning cash balance from the ending balance, adjusting for changes in assets, liabilities, and equity to determine net cash flow.

- This guide will explore the ins and outs of cash flow management, focusing on strategies specifically tailored for small businesses.

- With leasing, businesses benefit from predictable monthly payments that make budgeting easier and keep cash flow steady.

- These tools help you track payments in real time and send automatic reminders, saving time and reducing errors.

- Getting a firm grip on your company’s cash flow makes it less likely that you’ll ever have to scramble to make payroll or to pay recurring expenses like rent and taxes.

- Therefore, it may not be able to borrow or raise funds for future operations and obligations.

- We don’t own or control the products, services or content found there.

📊 Option 2: Spreadsheets (Manual Tracking)

Consult your bank about solutions such as a revolving line of credit, and monitor your credit score so that you will have access to funding when Certified Bookkeeper you need it. The Small Business Administration recommends using a 12 month cash flow statement using the direct method. Monitor your cash flow and expense ratios every month to see how your cost-cutting measures are working 25. The goal is to eliminate waste while continuing to invest in areas that drive growth. Take a close look at all your expense categories – bills, supplies, insurance, and employee costs. Use a simple spreadsheet to track where your money is going and spot areas where you can cut back without disrupting operations 2.